Healthcare

5 Ways Self-Insured Employers Can Use Price Transparency to Their Advantage

If you're a self-insured employer, you already know that managing healthcare costs is a high-stakes balancing act. You're on the hook for every claim, yet often blindfolded when it comes to what services actually cost, until now.

Thanks to the federal Transparency in Coverage (TiC) rule and the Hospital Price Transparency rule, a wealth of price data is finally available. While these rules were designed with patients in mind, savvy self-funded employers can use this data to gain the upper hand in negotiations, plan design, and cost containment.

Here’s how to turn the transparency tide in your favor.

1. Compare Prices Across Providers

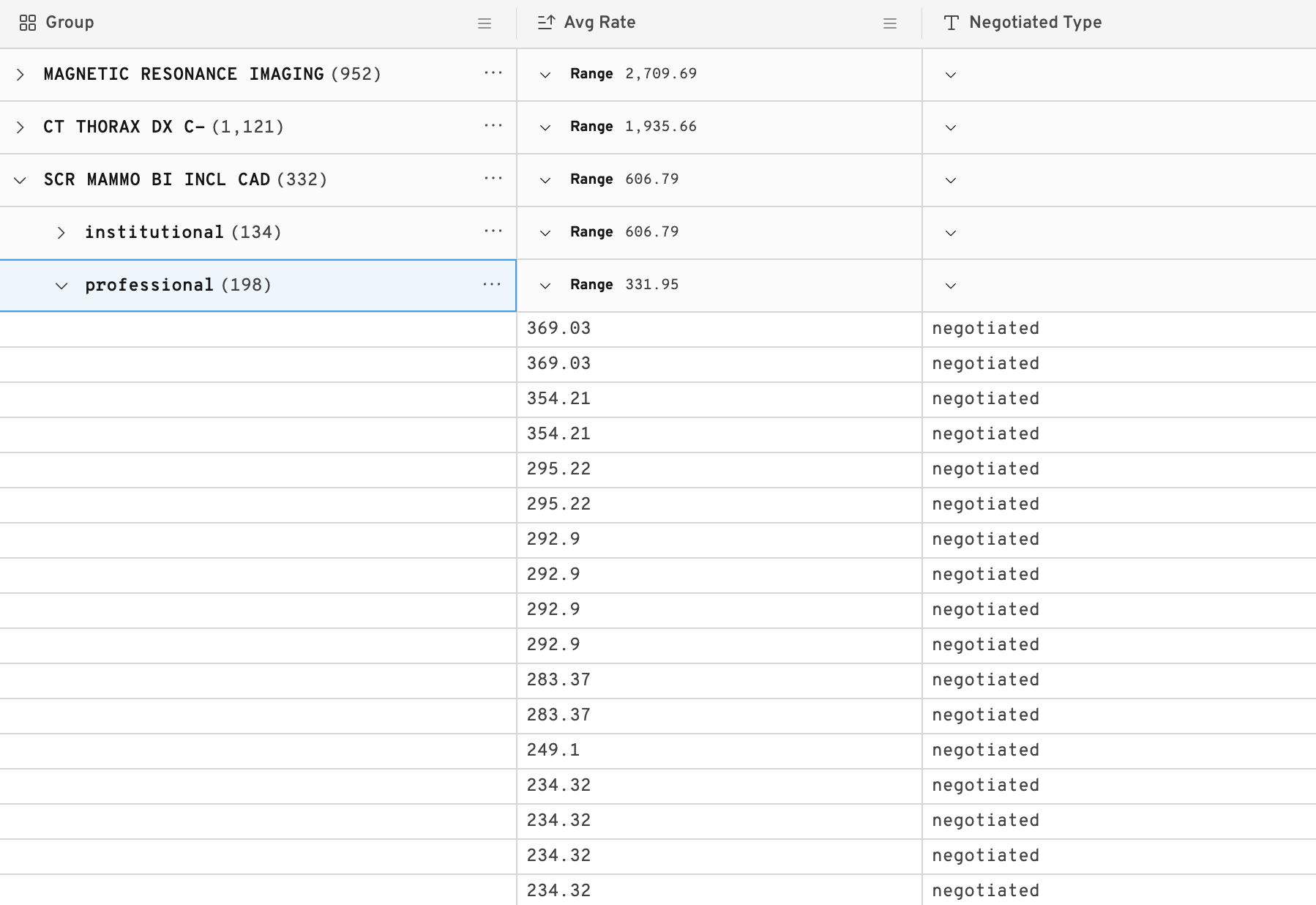

Price transparency files contain negotiated rates between insurers and providers—yes, even the ones your third-party administrator (TPA) doesn’t want you to see.

Using these machine-readable files (MRFs), you can identify:

- Price variation for the same procedure in your local market

- Providers that consistently charge more (or less) than average

- Facilities with outlier charges for high-volume services (MRIs, lab work, colonoscopies, etc.)

🛠 Tip: Use this intel to negotiate steerage programs, centers of excellence, or even direct contracts. If a local hospital is charging 4x the median for a routine service, you now have receipts.

2. Hold TPAs Accountable With Better Benchmarks

Your TPA or carrier may say their discounts are “best in class”—but now you can check that against actual negotiated rates across the market.

By analyzing how your network’s rates compare to competitors’ in the same ZIP codes, you gain leverage to:

- Push for better contract terms

- Scrutinize network performance

- Justify switching networks or carving out high-cost services

💭 Remember: discounts mean nothing if the starting price is inflated. Transparency data lets you benchmark from the ground up.

3. Identify High-Impact Shoppable Services

According to CMS, 70+ “shoppable” services must be disclosed under the Hospital Price Transparency rule. Think imaging, screenings, outpatient procedures and the types of care where patients can shop, if given tools.

Employers can:

- Focus plan design incentives (like lower copays) on low-cost, high-quality providers

- Provide employees with steerage tools using price benchmarks

- Analyze claims history to target the top shoppable spend areas

📈 Real-world example: Employers have used transparency data to discover massive variation in MRI pricing, then partner with a low-cost provider and waive copays to drive volume.

4. Go Beyond Unit Cost & Model Total Episode Costs

A knee replacement doesn’t just involve one line item. When transparency data is paired with your claims, you can model full episode costs across different facilities.

This allows you to:

- Evaluate bundled payment options

- Select high-value providers based on total cost of care

- Predict plan liabilities more accurately

💵 When you can see how often complications drive up downstream costs, the lowest sticker price may not be the best value.

5. Collaborate With Your Benefits Consultant or Analytics Partner

Let’s be honest: digging into raw MRFs is not for the faint of heart. Files are huge, messy, and often poorly standardized. But the opportunity is worth the effort.

Many benefits advisors and analytics firms now offer data and tools (like Gigasheet!) to make price transparency data accessible and actionable. Ask your partners:

- Are they ingesting MRF data alongside your claims?

- Can they benchmark your network against market rates?

- Do they help identify savings opportunities at the provider level?

🤔 If not, it may be time to upgrade.

Final Thoughts

For years, self-insured employers have been asked to manage healthcare spend with opaque data and limited control. Price transparency rules have flipped the script.

With the right tools and strategy, you can use this data to:

You’re not just a payer—you’re a purchaser. And now, you finally have the price tags.

Want help making this data actionable?

Let’s talk about how to apply price transparency analytics to your benefit strategy.

The ease of a spreadsheet. The power of price transparency.

.png)